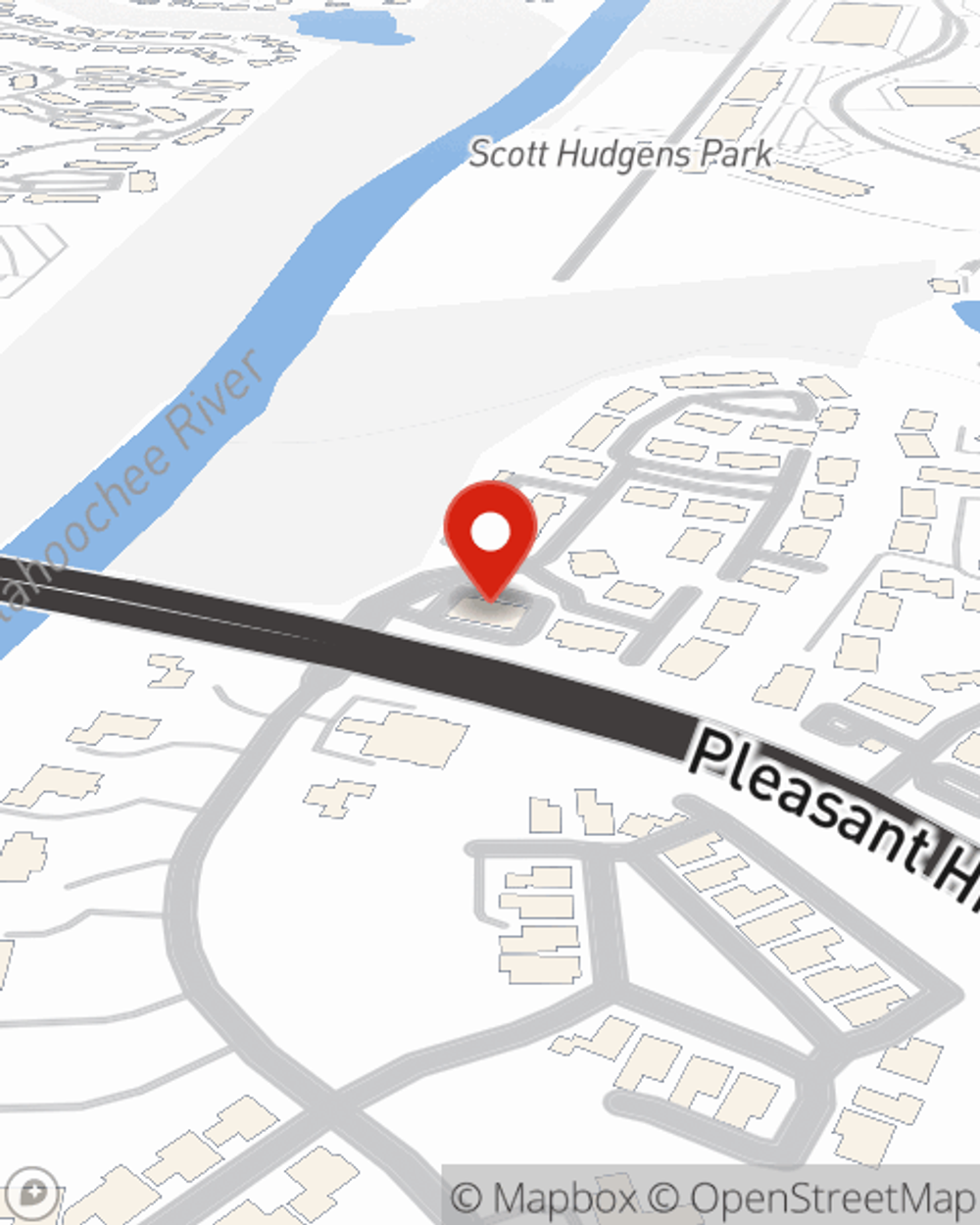

Auto Insurance in and around Duluth

Discover your car insurance options from State Farm

Insurance that's the wheel deal

Would you like to create a personalized auto quote?

- Georgia

- Duluth

- Gwinnett County

- Fulton County

- Dekalb County

- Berkeley Lake

- Johns Creek

- Alpharetta

- Suwanee

- Hall County

- Forsyth County

- Stone Mountain

- Atlanta

- Roswell

- Lake Lanier

- Norcross

- Lawrenceville

- Cumming

- Snellville

- Sandy Springs

- Gainesville

- Flowery Branch

- Buckhead

- Midtown

You've Got Places To Be. Let Us Help!

Your vehicle is not exempt from the unpredictable. Unlock unmatched coverage and savings with State Farm, the leading provider of auto insurance.

Discover your car insurance options from State Farm

Insurance that's the wheel deal

Great Coverage For Every Insurable Vehicle

Whether you're looking for reliable protection for your vehicle like car rental and travel expenses coverage, liability coverage and collision coverage, or terrific savings options like an anti-theft discount and accident-free driving record savings, State Farm can help. State Farm agent Sam Ashby can help you choose which unique options are right for you.

You don't have to ride solo when you have insurance from State Farm. Stop by Sam Ashby's office today for more information on how you can benefit from State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Sam at (678) 258-6278 or visit our FAQ page.

Simple Insights®

Driving distractions and how to avoid them

Driving distractions and how to avoid them

Driving distractions endanger drivers, passengers and pedestrians. Here are common driving distractions and tips on how you can help avoid them.

Car stolen or damaged by hail? Help understand comprehensive insurance

Car stolen or damaged by hail? Help understand comprehensive insurance

Learn what comprehensive auto insurance covers (theft, hail, vandalism & more), how it differs from collision, and why it’s important.

Simple Insights®

Driving distractions and how to avoid them

Driving distractions and how to avoid them

Driving distractions endanger drivers, passengers and pedestrians. Here are common driving distractions and tips on how you can help avoid them.

Car stolen or damaged by hail? Help understand comprehensive insurance

Car stolen or damaged by hail? Help understand comprehensive insurance

Learn what comprehensive auto insurance covers (theft, hail, vandalism & more), how it differs from collision, and why it’s important.