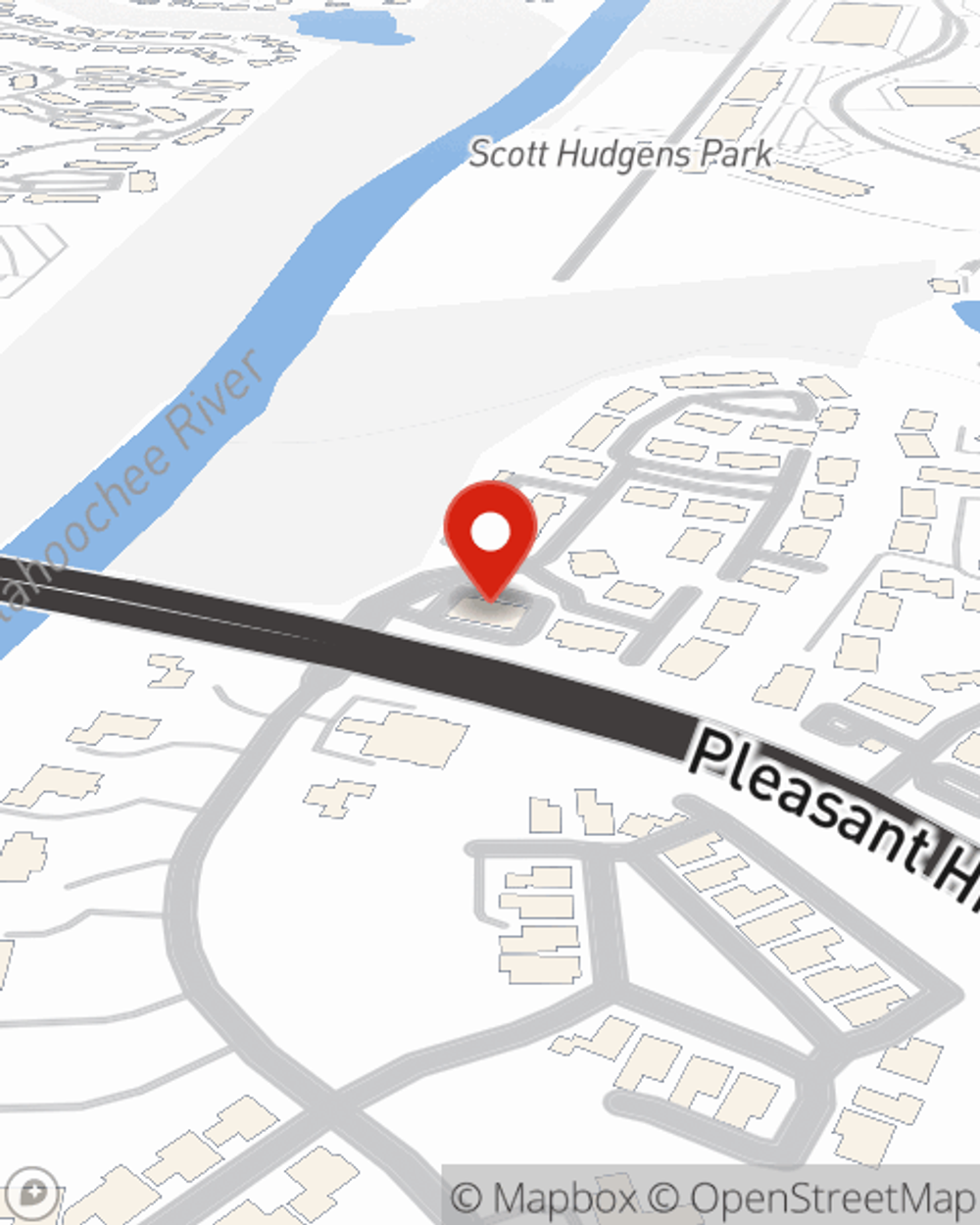

Business Insurance in and around Duluth

One of Duluth’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Georgia

- Duluth

- Gwinnett County

- Fulton County

- Dekalb County

- Berkeley Lake

- Johns Creek

- Alpharetta

- Suwanee

- Hall County

- Forsyth County

- Stone Mountain

- Atlanta

- Roswell

- Lake Lanier

- Norcross

- Lawrenceville

- Cumming

- Snellville

- Sandy Springs

- Gainesville

- Flowery Branch

- Buckhead

- Midtown

Business Insurance At A Great Value!

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Sam Ashby help you learn about excellent business insurance.

One of Duluth’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a barber or a photographer or you own an art gallery or a pizza parlor. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Sam Ashby. Sam Ashby is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

It's time to call or email State Farm agent Sam Ashby. You'll quickly perceive why State Farm is one of the leaders in small business insurance.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Sam Ashby

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.